How to Spend Your Crypto Without Selling

If you own a sizable amount of crypto, at some point you will want to use those funds. The easiest way is to sell some. But given the effort it’s taken to build the position, you likely don’t want to sell. You might still be bullish on crypto long term. And you don’t want to pay capital gains tax next year.

Stock investors have a solution to this problem—margin. Margin is using your existing holdings as collateral to borrow money. For example, someone with $1M in stocks can typically borrow 50% of that amount in cash. The interest rate varies from 2-8% depending on the amount borrowed.

Thanks to the development of decentralized finance (DeFi) products on Ethereum, crypto investors can also use margin. It is especially useful when you don’t want to sell your crypto but need to raise cash.

Crypto banks that provide margin fall in one of two camps: centralized providers such as BlockFi and Celsius or decentralized protocols such as MakerDAO, Compound, and AAVE. Centralized providers are companies. Because they are regulated entities, they only operate in specific countries and require real ID for registration. Most of them are not available in NY state. Decentralized providers are simply software (smart contracts) that run on the Ethereum blockchain. They work globally and require no personal information.

The most well regarded and battle tested among these services is MakerDAO (‘Maker’). Launched in 2017, Maker is the application that kicked off the DeFi movement. It has lived through crypto bull and bear markets and withstood numerous flash crashes. Today, Maker has $10B locked on its platform and serves as the base layer for dozens of DeFi applications.

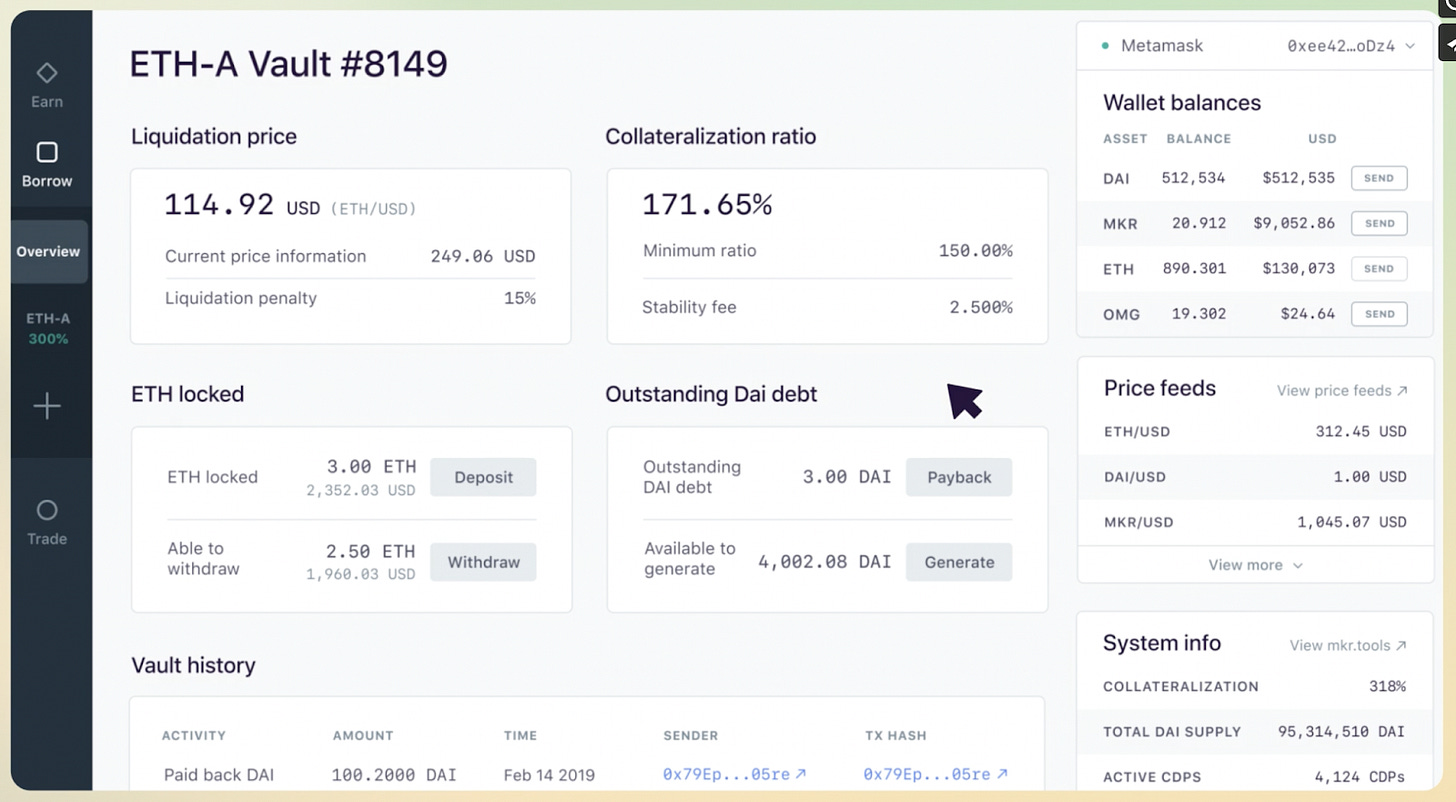

To use Maker you need some collateral and a crypto wallet. Maker takes Ethereum, wrapped Bitcoin, and a few other tokens as collateral. After collateral is deposited, Maker issues DAI. DAI is Maker’s native currency. It is a stablecoin that is pegged to the value of the USD. 1 DAI can be exchanged for $1 on cryptocurrency exchanges.

Given ETH as collateral, Maker currently offers two loans: ETH-A and ETH-C. The ETH-B loan is out of DAI. The two key parameters to consider are stability fee and liquidation ratio. The stability fee is the interest rate. The liquidation ratio is a measure of your borrowing power.

The ETH-A loan lets you borrow $100 for $150 of ETH collateral at 5.5% APY. The ETH-C loan lets you borrow $100 for $175 of ETH collateral at 3.5% APY. These are the maximum amounts you can borrow on these plans. Stay well below these limits to avoid liquidation.

The core idea behind these loans is over-collateralization. Because Maker holds your assets as collateral, it doesn’t need to trust you. If you don’t pay the loan, Maker sells and pockets your collateral. It’s over-collateralized because ETH as collateral is volatile. If you provide $100 in ETH and borrow $100 in USD and ETH suddenly falls 20%, Maker can’t make itself whole by selling your collateral. That’s why all these loans require substantially more collateral than the borrowing limit. By only lending $100 for $150 of collateral, Maker can withstand a sudden 33% drop in the price of ETH.

Using the ETH-A vault, you could deposit $100k in ETH and generate $30k in DAI. Taking out only $30k means you have some protection against ETH price declines. If ETH falls by 50%, your collateral will fall to $50k—still enough to cover the 150% collateralization requirement.

Maker loans are open ended. There are no terms and no specific dates to pay back interest or principal. In theory if your collateral’s value appreciates faster than interest accumulates, you could keep the loan open indefinitely without any repayments. Paying off your DAI balance closes the loan and returns your collateral.

There are three main caveats to using Maker loans: gas fees, interest rate hikes, and liquidations.

Maker runs on the Ethereum blockchain. Performing transactions on the Ethereum blockchain costs ether. Simple transactions might cost only $5 of ETH. Complex transactions could cost hundreds of ETH. As of April 2021, it costs roughly $300 to open a Maker Vault. It costs roughly $50 to deposit into the vault, generate DAI, or payback DAI. Every transaction costs money. As such, Maker currently only makes sense for relatively large transactions. If Ethereum capacity scales in the coming year, gas prices should come down.

Maker’s interest rate is variable. Although it’s generally stable from day to day, it may drift higher or lower over the course of weeks and months. In 2019, it spiked to 20%. While Maker is far more stable than its early years, do not think of it as a fixed interest rate product.

Liquidation is the ultimate disaster for a Maker user. If you borrow too aggressively against your collateral, liquidations could occur even with a modest decline in collateral value. Even if you post collateral to cover a 50% decline in the price of the collateral, a 55% flash crash could still wipe you out. Unlike a brokerage account, there is no margin call or text notification. If your collateral falls below the liquidation price, Maker will liquidate your assets within one hour.

At its best, Maker is a magic money printer in the cloud. It turns your crypto holdings into cash without having to sell and realize capital gains. It helps you HODL and stay invested. Like any form of leverage, Maker is a double edged sword. Misuse can result in liquidation, destroying years of accumulation while realizing capital gains. Use with care.

Resources:

Maker whitepaper

Maker Vault video walkthrough

Interview with Maker founder Rune Christensen

part 2 is to put your DAI to work in yield farms, then spend the yield your DAI makes for you. this way, you always have your collateral available in case the price starts dropping suddenly.

But why take a "loan" with makerDAO when u can earn interest with Celsius, etc.? sorry if this is a stupid question, I'm still learning!